Construction PPIs jump in January; housing starts and permits slide; ABI turns positive Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

The producer price index (PPI) for final demand increased 0.4%, not seasonally adjusted (0.2%, seasonally adjusted), in January and 1.2% over 12 months, the Bureau of Labor Statistics (BLS) reported last Wednesday. The PPI for final demand covers about twice as much production as the prior headline PPI for finished goods, because the new index includes final demand construction (2% of total final demand) and final demand services (64%), in addition to final demand goods (34%). AGC posted an explanation and tables focusing on construction prices and costs. Construction is limited to five types of nonresidential buildings that BLS says make up 34% of total construction. Other building types, along with residential and nonbuilding construction, are not included. There are separate final demand indexes for private capital investment, government, personal consumption and exports, but only the first two are considered buyers of construction, since housing is not measured and buildings are not exported. The PPI for final demand construction rose 0.6%, not seasonally adjusted, in January and 3.1% over 12 months, as did the PPI for construction for private capital investment, which makes up 69% of the final demand construction total. The PPI for construction government (31% of the construction total), which reflects different proportions of the same five building types used for the private capital investment index, rose 0.8% and 3.1%, respectively. The overall PPI for new building construction – a measure of the price contractors say they would charge to put up a fixed set of five categories of buildings – increased 0.7% for the month and 3.3% since January 2013. The PPI for new school construction (26% of the index for new nonresidential buildings) rose 1.0% and 3.9%, respectively; offices (34% of the total), 0.6% and 2.9%; industrial buildings (13% of the total), 0.5% and 4.0%; health care buildings (16% of the total), 0.4% and 2.9%; and warehouses (11% of the total), 0.3% and 2.3%. The PPI for inputs to construction – an average of the cost of all materials used in construction plus items consumed by contractors, such as diesel fuel – rose 0.6% and 1.2% year-over-year. Major construction materials with notable one- or 12-month price swings included gypsum products, for which the PPI jumped 7.4% in January and 11.6% year-over-year; insulation materials, 1.5% and 8.2%, respectively; lumber and plywood, 2.4% and 7.7%; steel mill products, 1.2% and 0.5%; and diesel fuel, -1.9% and -3.3%. PPIs for new, repair and maintenance work on nonresidential buildings by plumbing contractors rose 1.1% and 4.2%; roofing contractors, 0.7 and 1.9%; concrete contractors, 0.4% and 1.4%; and electrical contractors, 0 and 1.7%.

Privately owned housing starts tumbled 16% in January at a seasonally adjusted annual rate, following a 4.8% drop in December, and 2.0% year-over-year, the Census Bureau reported last Wednesday. Starts in both months were likely dragged down by widespread adverse weather that impeded construction and deterred would-be buyers. Single-family starts fell 16% in January and 6.7% over 12 months; starts of multifamily buildings (5 or more units) fell 13% in January but rose 9.9% year-over-year. Building permits were mixed: -5.4% for the month but +2.4% over 12 months, with single-family -1.3% in January and +2.4% since January 2013 and multifamily (5+ units), -13% and +2.7%, respectively.

The number of architecture firms reporting that billings rose in January edged out the number reporting decreases, the American Institute of Architects stated last Wednesday in releasing its Architecture Billings Index (ABI). The ABI, a harbinger of construction spending 9-12 months later, hit 50.4 after two months just below the breakeven level of 50. (An annual revision of seasonal adjustment factors changed some past readings.) Practice specialty sub-indexes (calculated as three-month averages) varied: residential (mainly multifamily), 51.8, down from 53.0 in December; commercial/industrial, 50.9, up from 49.7; institutional, 46.5, nearly unchanged from 46.4; and mixed practice, 48.4, down from 49.9.

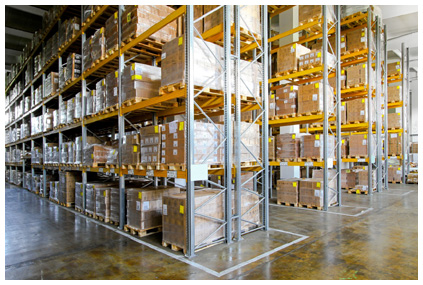

“Demand for U.S. warehouse space exceeded expectations in the fourth quarter of 2013, with absorption for the quarter reaching among the highest levels on record, and warehouse vacancy rates in the largest U.S. market fell to levels not seen since the early 2000s,” commercial real-estate tracking firm CoStar reported on February 4. For all of 2013, “162 out of 210 markets showed positive net absorption for a total of 162.6 million square feet, a strong 39% increase over the 117 million square feet in 2012. [New supply] is now beginning to ramp up. In the last year, most markets have started to move into what the analysts termed the late expansionary phase, where most major warehouse markets inevitably begin to see new construction exert pressure on occupancies….the 82 million [square feet]under construction at end of December has jumped to 98 million in the first few weeks of 2014….The Inland Empire [California] and Dallas/Fort Worth warehouse markets are running neck and neck as the strongest in terms of both demand and new supply….Houston, Chicago and Phoenix are also logging strong levels of new supply.” Diana Olick wrote on January 21 in CNBC’s Realty Check, “As Amazon starts moving its products closer to its customers, others will likely follow suit, meaning more need for those smaller distribution centers that are closer to major metropolitan areas….Today's modern distribution systems require state-of-the-art facilities.”

The Data DIGest is a weekly summary of economic news; items most relevant to construction are in italics. All rights reserved. Sign up at www.agc.org/datadigest.

AGC's Data DIGest: February 17-21, 2014

by Ken Simonson | February 24, 2014

Add new comment