Construction PPIs drop in January; Dodge starts rebound; ABI slips; housing is mixed

Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

The producer price index (PPI) for final demand decreased 0.7%, not seasonally adjusted (-0.8%, seasonally adjusted), in January and was flat over 12 months, the Bureau of Labor Statistics (BLS) reported on Wednesday. BLS introduced numerous new indexes for inputs to construction and updated the "relative importance" weights for the inputs to each series (available to readers by request to simonsonk@agc.org). AGC posted an explanation and tables focusing on construction prices and costs. Final demand includes goods, services and five types of nonresidential buildings that BLS says make up 34% of total construction. The PPI for final demand construction, not seasonally adjusted, rose 0.4% in January and 1.9% over 12 months. The overall PPI for new nonresidential building construction—a measure of the price that contractors say they would charge to build a fixed set of five categories of buildings—climbed 2.0% since January 2014. The 12-month increases ranged from 1.0% for healthcare construction to 1.6% for schools, 1.9% for industrial buildings, 2.3% for warehouses, and 2.4% for offices. PPIs for new, repair and maintenance work on nonresidential buildings by electrical contractors 1.0% over 12 months; plumbing contractors 1.2%; concrete contractors, 2.3%; and roofers, 4.0%. A new set of PPIs for inputs to construction, excluding capital investment, labor and imports, adds services to the previous PPI for inputs to construction industries, now renamed inputs to construction industries, goods. Goods now constitute 60% of the index (including 7% for energy); services, 40% (trade services, 25%; transportation and warehousing services, 4%; other services, 10%). While the overall PPI for inputs to construction fell 1.0% from December to January, a 19% plunge in energy prices (mainly diesel fuel) accounted for the decline. In contrast, PPIs rose 0.3%for goods less foods and energy and 0.5% for services. Materials with notable one- or 12-month price changes included diesel, -21% and -40%, respectively; copper and brass mill shapes, -3.6% and -9.3%; aluminum mill shapes, -2.2% and 7.9%; and cement, 3.6% and 8.4%. Prices for gypsum products rose 4.3% in January but this was less than in the previous three Januarys, and the 12-month change was only 0.2%.

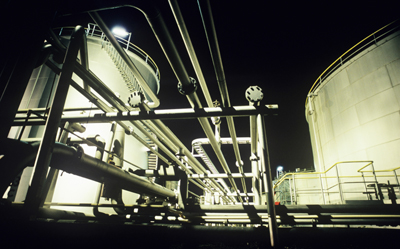

The value of new construction starts climbed 9% at a seasonally adjusted annual rate in January following a 16% plunge in November, Dodge Data & Analytics (formerly McGraw Hill Construction) reported on Friday, based on data it collected. "The increase for total construction was the result of an especially strong performance by the nonbuilding construction sector, which benefitted from the start of a massive liquefied natural gas [LNG] terminal facility in Texas. Meanwhile, nonresidential building lost momentum for the second month in a row and residential building pulled back due to a slower pace for multifamily housing. On an unadjusted basis, total construction starts in January were reported...up 18% from the same month a year ago....'During 2014 and now early 2015, the month-to-month pattern for construction starts has often reflected the presence or absence of exceptionally large projects,' stated [Chief Economist Robert Murray]. 'For much of 2014, a substantial share of this work was petrochemical-related, such as a $3.0 billion Exxon petrochemical plant expansion in Texas. Towards the end of last year, a pickup in [LNG]-related facilities emerged, led by the start of the $3.6 billion Dominion Cove Point Liquefaction Project in Maryland, and January included $6.0 billion estimated for the start of two segments of a huge [LNG] export facility in Texas. The month-to-month variation for overall construction starts is taking place around what is still a rising trend. For nonresidential building, the continued improvement by its commercial and now its institutional project types should enable this sector to register more growth in 2015, notwithstanding a sluggish January. For residential building, the strengthening job market and some easing of lending standards for home mortgages are expected to help single-family housing see moderate improvement relative to a flat 2014.'...Useful perspective is made possible by looking at 12-month moving totals, in this case the 12 months ending January 2015 versus the 12 months ending January 2014, which lessens the volatility present in one-month comparisons. For the 12 months ending January 2015, total construction starts were up 9%," with nonresidential building up 18%; residential building, up 8%; and nonbuilding construction, up 1%.

The Architecture Billings Index, which measures whether architecture firms' billings rose or fell from the prior month (any score over 50 denotes more firms reported growth than reported decline) declined to a near-neutral reading of 49.9 in January from a revised level of 52.6 in December, the American Institute of Architects (AIA) reported on Wednesday. "Likely some of this can be attributed to severe weather conditions in January," AIA Chief Economist Kermit Baker. Among four practice segments (based on three-month moving averages) the reading for multifamily residential decreased to 51.4 from 53.5 but remained above 50 for the 40th consecutive month; commercial/industrial slipped to 50.9 from 51.1 but was above 50 for the 22nd month in a row; institutional rose to 53.0 from 52.0; and mixed practice declined from 47.8 to 46.9, the third-straight reading below 50.

Housing starts declined 2.0% at a seasonally adjusted annual rate in January from December and soared 19% from January 2014, the Census Bureau reported on Wednesday. Single-family starts slumped 6.7% from a month earlier and increased 16% from a year ago. The often-volatile multifamily (buildings with 5 or more units) starts increased 12% in January and 25% over 12 months. Building permits slipped 0.7% for the month and rose 8.1% over 12 months, as single-family permits fell 3.1% from December and gained 5.8% from a year ago, while multifamily permits increased 3.3% and 14%, respectively.

The Data DIGest is a weekly summary of economic news; items most relevant to construction are in italics. All rights reserved. Sign up at www.agc.org/datadigest.